“Navigating Salary Requirements for Expatriates in India: A Comprehensive Guide to Comfortable Living”

Introduction:

Now that I am close to the completion of my third consecutive year back in India (As a part of my second attempt to return back to India), I can help with this frustrating question by looking at my own expenses and benchmarking it with some selected peers.

India, with its rich culture, burgeoning economy, and diverse lifestyle options, attracts expatriates from around the globe. However, understanding the financial landscape is crucial for expats to ensure a comfortable standard of living. In this article, we delve into the salary requirements for expatriates in India to live comfortably, providing insights and numerical breakdowns to facilitate informed decision-making.

Global real estate agency Knight Frank said in its new wealth report (May 2023) that in India, the individual wealth required to reach the 1 per cent threshold in India is $175,000, which translates roughly to Rs 1.44 crore. India is placed 22nd on the list of countries, above South Africa, the Philippines and Kenya.

One could be fooled into thinking that salary requirements are therefore low due to the much lower cost of living, but this could be a big mistake as I was to find out 13 years back when I made my first attempt at moving to India in the Mega City of Mumbai. I settled for a salary that was approximately 30% of what I was making in the US without realising the cost of living in Metros in India, especially with family and kids.

Cost of Living Overview:

Before discussing specific salary figures, it’s essential to grasp the cost of living in India. While India is generally considered to be an affordable country, there can be significant disparities depending on the city and lifestyle preferences. Some key categories are listed here:

Housing:

First the bad news: If you want to own your 1800 sq. ft home, and you want a home in one of the big metros at a highly central location, then be prepared to shell out at least $500,000 (Rs 4 Cr INR). This is the minimum. The good news is that the “Ultra Luxury Market” under which these homes are categorised in India will likely grow at a rate of 10% or more for the next few years, after coming up from a long down cycle for luxury real estate. So you could consider this as a working investment that will help your net worth grow in the long run.

If you consider rentals, then the situation gets better.

Food and Groceries:

• Food expenses can be relatively modest, especially if one opts for local produce and traditional cuisine.

• A monthly grocery bill for a family of four can range from ₹20,000 to ₹40,000, depending on dietary preferences and lifestyle choices.

Transportation:

• Public transportation in India is relatively affordable, but the availability and quality vary across cities.

• Owning a car can be expensive due to high fuel costs, maintenance, and insurance premiums.

The good news is that Drivers/Chauffeurs are relatively cheap and are also available “on-call” reducing the need for a full time Driver. This is highly recommended considering India’s horrible traffic with is exacerbated by huge infra projects all over the country, leading to road diversions, etc.

Healthcare:

• India offers a mix of public and private healthcare facilities. Most expats should only use private healthcare (Which is relatively inexpensive by global standards), since government health care is a decade or so away from meeting global standards (if at all).

• India’s greatest strength in this field is Ayurveda, a holistic 5000 year old medical practice, which has minimal side effects and is also relatively cost effective with better results. I have been able to halve my dosage of allopathic medications after my move here and my wife and parents have benefited significantly from their own move to this alternative treatments for various ailments. We all still continue to use western medicine as well but have minimised its use.

• Health insurance is advisable for expatriates to cover medical expenses adequately.

Education:

• If you have school-going children, international schools may be preferred, which can be expensive.

• However, there are some very good historically reputed private schools which are cheaper but very difficult to get into because of demand. Use your alumni status to good effect if you can to get into one of these schools. (This is what I did for my daughter).

Salary Requirements for Comfortable Living:

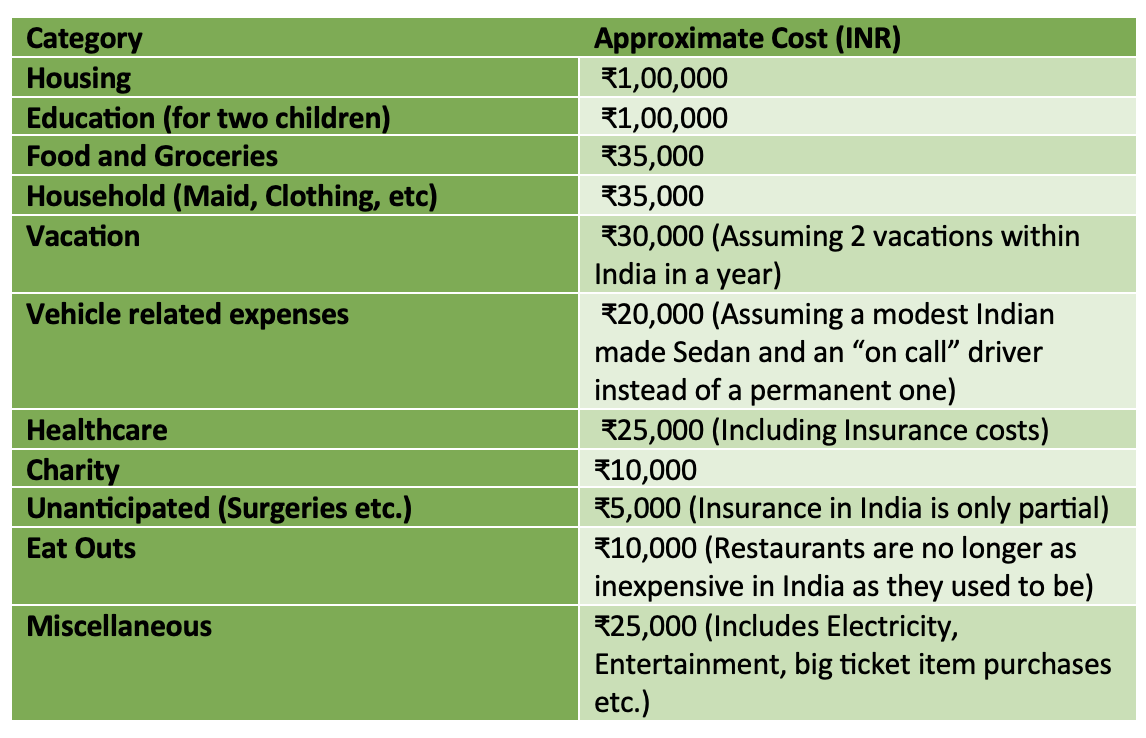

Based on the cost of living components, here’s a breakdown of the minimum monthly salary an expatriate from the US between 35 and 50 might need to live comfortably in India, considering a family of four (two adults and two children):

Therefore, in my analysis, the approximate monthly expense total for a comfortable life is ₹4,00,000 per month ($5000/Month) for a family of four that is planning on renting a a 1500-2000 Sq ft home in a central location of a major metro in India.

So for someone who wants a ball-park minimum number and who doesn’t have his own housing in India, the starting number to negotiate with for an Indian employer is an annual salary of Rs 50 Lakhsunless you are a dual income family, where this number can be met between you and your spouse. Note that your expenses are also likely higher by 10%-20% if you are a dual income family due to additional costs.

Any offer higher than this amount is rare for most Indian companies, because of the amount of talent available within India and within the Indian companies that would settle for a far lesser amount; they would be your direct competition for these roles. That being said, the number of these high paying roles is increasing by the day, because India Inc is now seeing the value in attracting global talent; so you may be one of those lucky hardworking people.

Also, as pointed out by my friend, Arjun Mehtain one of the comments below, this analysis does not include a 30% Income Tax surcharge on such salaries. It is assumed here that you will work with a CPA/CA to minimize this by adapting various strategies which will involve you using your existing savings to offset some taxes.

Additionally, this income does not include any provisions for savings. You would need to save at least 20% for retirement, higher education for kids etc. As such, the number above constitutes a bare minimum if you want the comfortable lifestyle mentioned.

Some financial compromises may be made on location of home, driving your own vehicle, reducing your maid and cook’s workload in your home, cheaper schools for kids, less eating out and others, but then you would no longer live a comfortable life like you would prefer to.

Conclusion:

While India offers an array of opportunities and experiences for expatriates, understanding the financial implications is paramount for a smooth transition and comfortable living. The outlined salary requirements provide a baseline for expatriates to gauge their financial preparedness and negotiate compensation packages effectively. Moreover, adapting to local customs, exploring cost-saving measures, and seeking financial advice can further enhance the expatriate experience in India. By aligning financial expectations with reality, expatriates can embark on their Indian journey with confidence and peace of mind.